Model 3 pushes Tesla to its limits

【Summary】Tesla's Model 3 will push Tesla to its limits as a manufacturer and test investors' patience with a perennially unprofitable company.

Investors' patience also put to the test

Tesla Motors had a quarter of nagging distractions.

In late June, CEO Elon Musk proposed a puzzling acquisition of another company he's affiliated with, SolarCity. There was a fatal crash possibly involving Tesla's Autopilot system that's now under federal investigation and concern over nondisclosure agreements customers were being asked to sign on safety-related suspension repairs.

But none of this is what keeps Musk or investors up at night.

It's the Model 3 that does.

Musk: Pushing timetable hard

Tesla's attempt at a mass-market, long-range electric car won't have a groundbreaking powertrain or gull-wing doors. And yet this most mundane Tesla product will carry the highest stakes. It will push Tesla to its limits as a manufacturer and test investors' patience with a perennially unprofitable company.

"I really don't care a whole lot" about the SolarCity acquisition, David Whiston, a strategist at Morningstar, told Automotive News. Investors, he added, "are most concerned with nailing the Model 3, not becoming a solar company."

Tesla said the design for the Model 3 has finally been frozen, and it already has some initial production equipment for stamping and painting in place.

To nail the launch, Tesla expects to be writing big checks for the rest of the year, on top of the heavy spending it has already committed for plant upgrades and the new factory in Nevada that will supply batteries for the Model 3.

Tesla recorded $295 million in second-quarter capital expenditures and expects full-year capital spending to accelerate to $2.25 billion to support the ramp-up for the Model 3 and its goal of producing 500,000 vehicles in 2018.

For this, Tesla will be relying heavily on the $3.25 billion in cash it says it has on hand -- counting $1.7 billion from a recent secondary offering -- though many analysts believe it will need to raise more in the near future to keep its plans on schedule.

Timing will be crucial, especially if delays cause investors to get impatient and sour on the very idea of an affordable Tesla.

"The bigger question is: How long can Tesla lose money, and how wide can its losses get, before Wall Street cries foul?" said Karl Brauer, senior analyst for Kelley Blue Book.

To be sure, patience has long been a virtue of Tesla investors. Its second-quarter results, which were worse than expected, marked the 13th straight quarter of net losses. Deliveries were behind schedule, and investors heard familiar hints about non-GAAP profitability by year end. Yet the stock, already having recovered from doubts about the SolarCity deal, barely budged.

Musk has repeatedly targeted July 1, 2017, as the start date for Model 3 production, but much of that depends on external suppliers and internal teams hitting the ambitious timetable he has set.

"I don't expect us to be at full production on July 1," Musk said sternly on last week's call. "But I have to drive all suppliers and internal efforts to that date knowing that some will fall short.

"And those that fall short will be cut out of the picture."

resource from: Automotive News

-

Elon Musk confident that Tesla can attain staggering 20-fold increase in production speed in Fremont

-

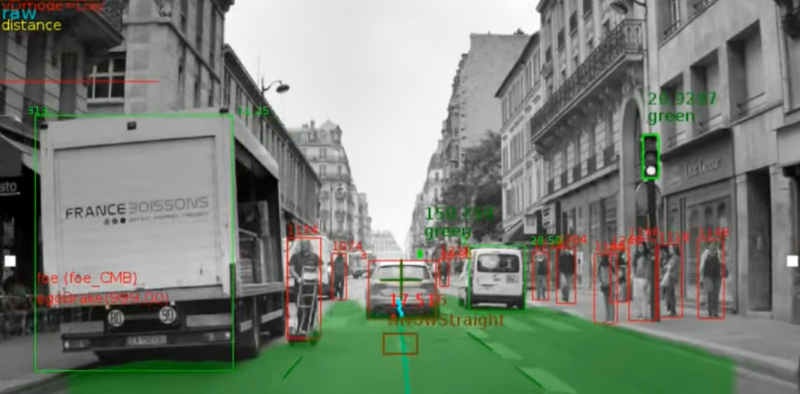

Tesla responds to Mobileye’s comments on Autopilot, confirms new in-house ‘Tesla Vision’ product

-

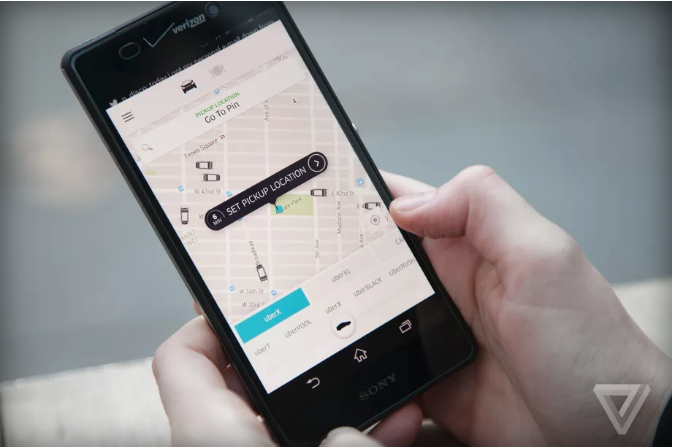

Uber will repay thousands of riders for misleading them about tips

-

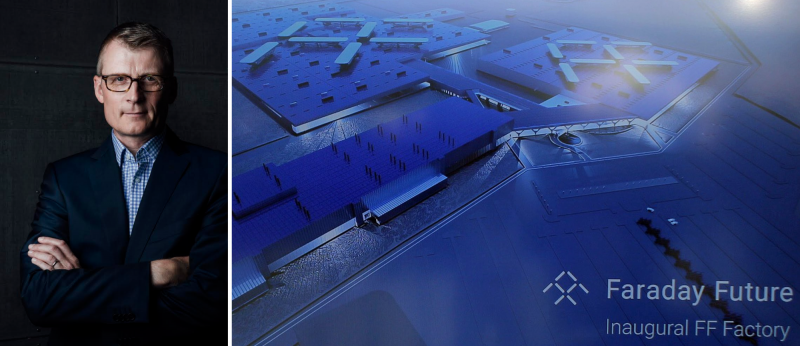

Faraday Future adds top VW executive to bring to market its upcoming electric vehicles

-

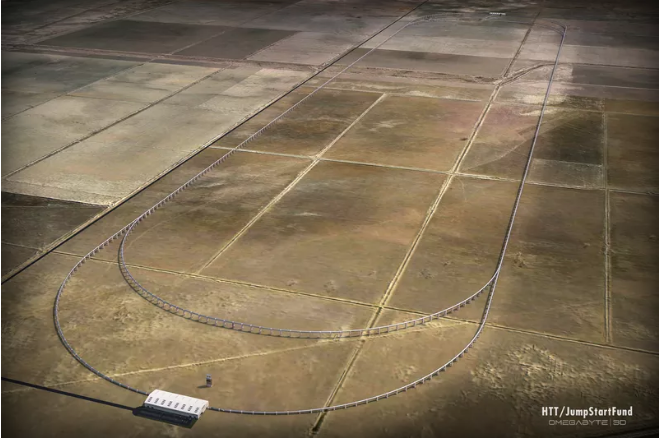

Hyperloop track construction in California is delayed

-

Federal funds to back Portland storefront for electric-car marketing, pop-up roadshows

-

Tesla announces a partnership in South Korea for first store and 25 charging stations

-

DOE small biz voucher awards include vehicles and fuel cells

- Lucid’s New ‘Stealth Look’ Appearance Package for the Electric Air Sedan Compliments its High Performance DNA

- GM Offering to Buy Out Buick Dealers That Don’t Want to Sell EVs

- General Motors is Building a Coast-to-Coast DC Fast EV Charging Network in the U.S. in a New Partnership with Travel Center Operator Pilot Company

- Report Claims Nissan Leaf Will Be Discontinued by 2025

- Mercedes-Benz is Partnering with Game Engine Developer Unity Technologies to Create Immersive, 3D Infotainment Screens and Displays for its Future Vehicles

- Volkswagen’s Software Unit CARIAD to Co-Develop a System-on-Chip With STMicroelectronics for the Automaker’s Future Software-defined Vehicles

- Amazon Customers in Texas and California Will Begin Receiving Packages via Prime Air Drones Later This Year

- China’s CATL to Supply Honda with 123 GWh of Electric Vehicle Batteries by 2030

- GM’s Buick Division is Getting a Makeover, Will Only Offer Electric Vehicles by the End of the Decade

- General Motors Launches ‘EV Live’ an Interactive Virtual Experience Where Participants Can Learn More About Electric Vehicles

About Us

About Us Contact Us

Contact Us Careers

Careers